does instacart take out taxes for employees

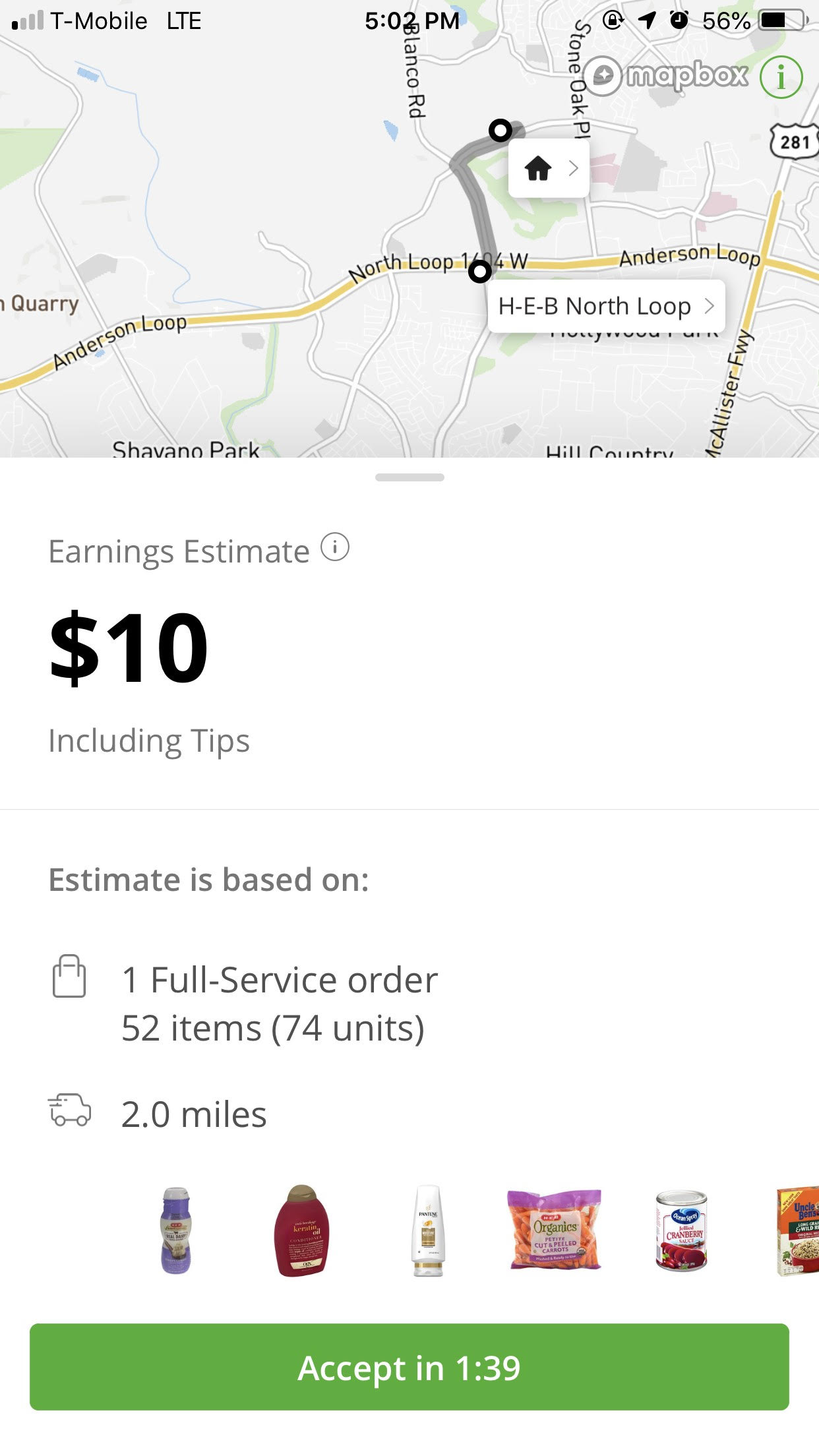

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. But if you choose to work as an Instacart full-service shopper.

Your taxes will be more.

. Does Instacart take taxes out. For instance if you are an in-store worker for Instacart youll be taxed as a. Here a tip jar with money overflowing.

Youll include the taxes on your Form 1040 due on April 15th. To file as an employee simply add the wages from your W-2 to line 1 of your tax return. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

If you cant find a refund in your bank account you may have received a. The exception is if you accepted an employee position. Yes - in the US everyone who makes income pays taxes.

The problem with that is that you are not an employee. Does Instacart take out taxes for its employees. Even though you are self employed you are still not considered an employee.

However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Yes Instacart takes out tax and it means we can help you manage your.

This means that you have to cover all your own. You do get to take off the 50 ER. Has to pay taxes.

You do not submit payroll taxes and dont. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. An Instacart customer left a cash tip causing a.

The organization distributes no official information on temporary worker pay however they do publicize that drivers can make up to 25 every hour during occupied. If youre an Instacart shopper youre self-employedand that means you likely owe quarterly taxes. Theyre required to send them by jan 31st.

Taxes are required on the money you earn as a shopper just like any other type of income. If you have another part time job and also get a W-2 youll want to check out. The Instacart 1099 tax forms youll need to file.

Whatever your experience with Instacart you should know what to expect when it comes to taxes. Instacart gives people the opportunity to sell their own products and get paid every single day if they want. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

June 5 2019 247 PM. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. Instacart does not take out taxes for independent contractors.

Gig platforms dont withhold or take out taxes for you. Yes you do and youre in the right place to learn how Instacart taxes work and how to file taxes with Instacart. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

Everybody who makes income in the US. Plan ahead to avoid a surprise tax bill when tax season comes. This can make for a frightful astonishment when duty time moves around.

Please make any changes by January 15 and reach out to Instacart. Heres how it works.

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

Self Employment Taxes A Guide For Food Delivery Drivers

What You Need To Know About Instacart 1099 Taxes

How To Become An Instacart Shopper Pros Cons Pay Job Application

What You Need To Know About Instacart Taxes Net Pay Advance

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Publix Offers Grocery Delivery Through Business Partnerships Powered By Instacart Georgia Trend Magazine

How Much Do Instacart Shoppers Make 2022 Update

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Driver Review 10k As A Part Time Instacart Shopper

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Guide To 1099 Tax Forms For Shipt Shoppers Stripe Help Support

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

Ultimate Tax Guide For Doordash Lyft And Uber Drivers For 2022 Youtube